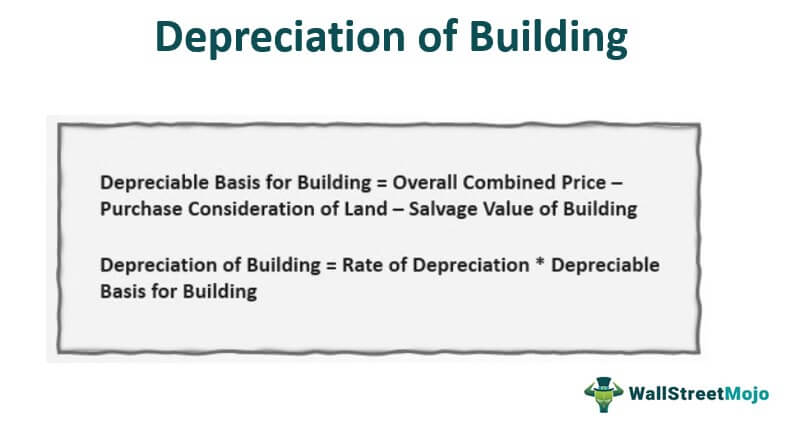

Depreciation formula for building

Depreciation per year Book value Depreciation rate. In our example 95000 divided by 25 years equals depreciation of 3800 a year.

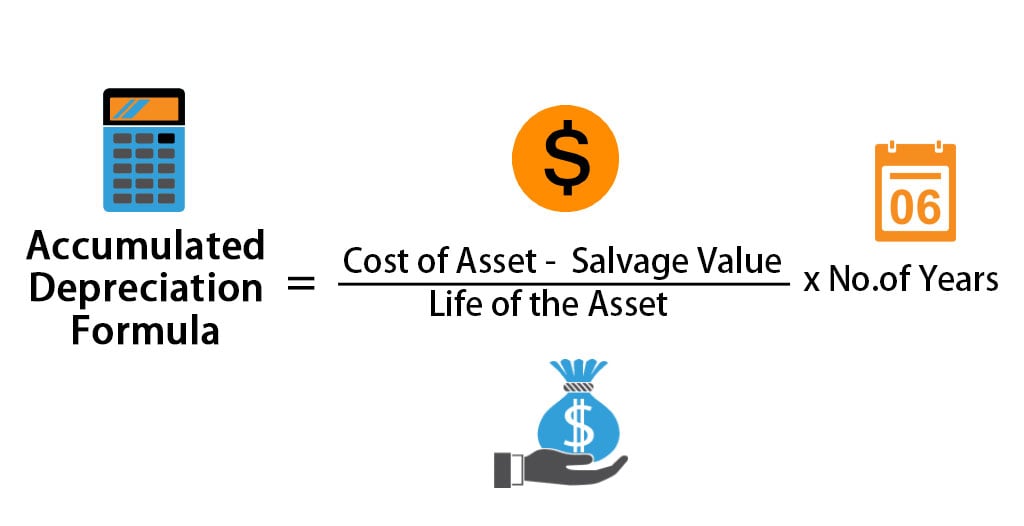

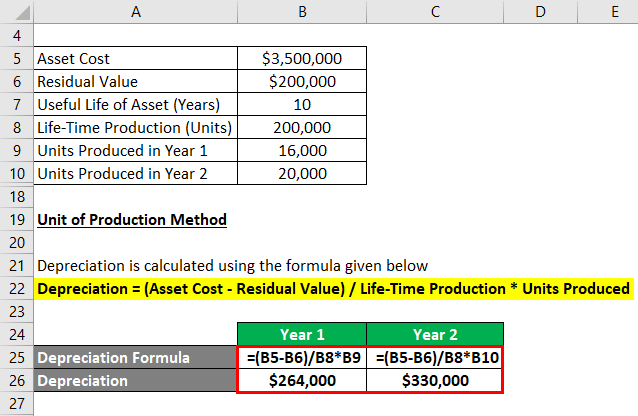

Accumulated Depreciation Formula Calculator With Excel Template

A regulation relating to IRA rollovers stipulating that whenever a financial asset is withdrawn from a retirement account or IRA for the purpose of.

. The process of depreciation starts by having the property placed in servicerental or lease. In order to calculate the depreciation expense for each accounting period we must know the depreciation rate first which can be determined through the following formula. A building can be depreciated but land cannot ie.

The remainder of the useful age is the actual selling price of the construction. Depreciation Formula and Calculator. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100.

In most cases when you buy a building the. Depreciation on real property like an office building begins in the month the building is placed in service. Ad Download or Email Depreciation Worksheet More Fillable Forms Register and Subscribe Now.

To calculate the straight-line depreciation rate for your asset simply subtract the salvage value from the asset cost to get total depreciation then divide that by useful life to get. Buildings and equipment will eventually wear out and need to be replaced. Add the market value.

Cost of each part at the present rate is calculated based on. The formula for depreciating commercial real estate looks like this. Basis 39 years Annual allowable depreciation expense.

Cost of property Land value Basis. This is called the mid-month convention. 1250000 cost of property.

Convention states that residential rental property depreciates by. Divide the depreciable value by the buildings useful life to determine the yearly depreciation. Same Property Rule.

Number of years after constructionTotal age of the building 1060 16. Based on the depreciation method the valuation of the buildings is divided into four parts. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice.

In 275 years the US.

Calculating Depreciation Youtube

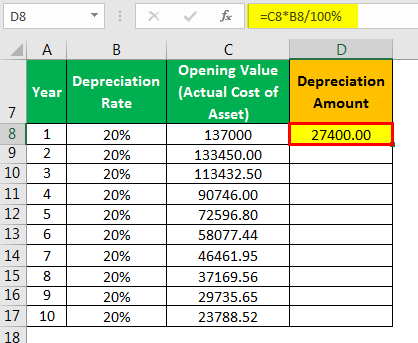

Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

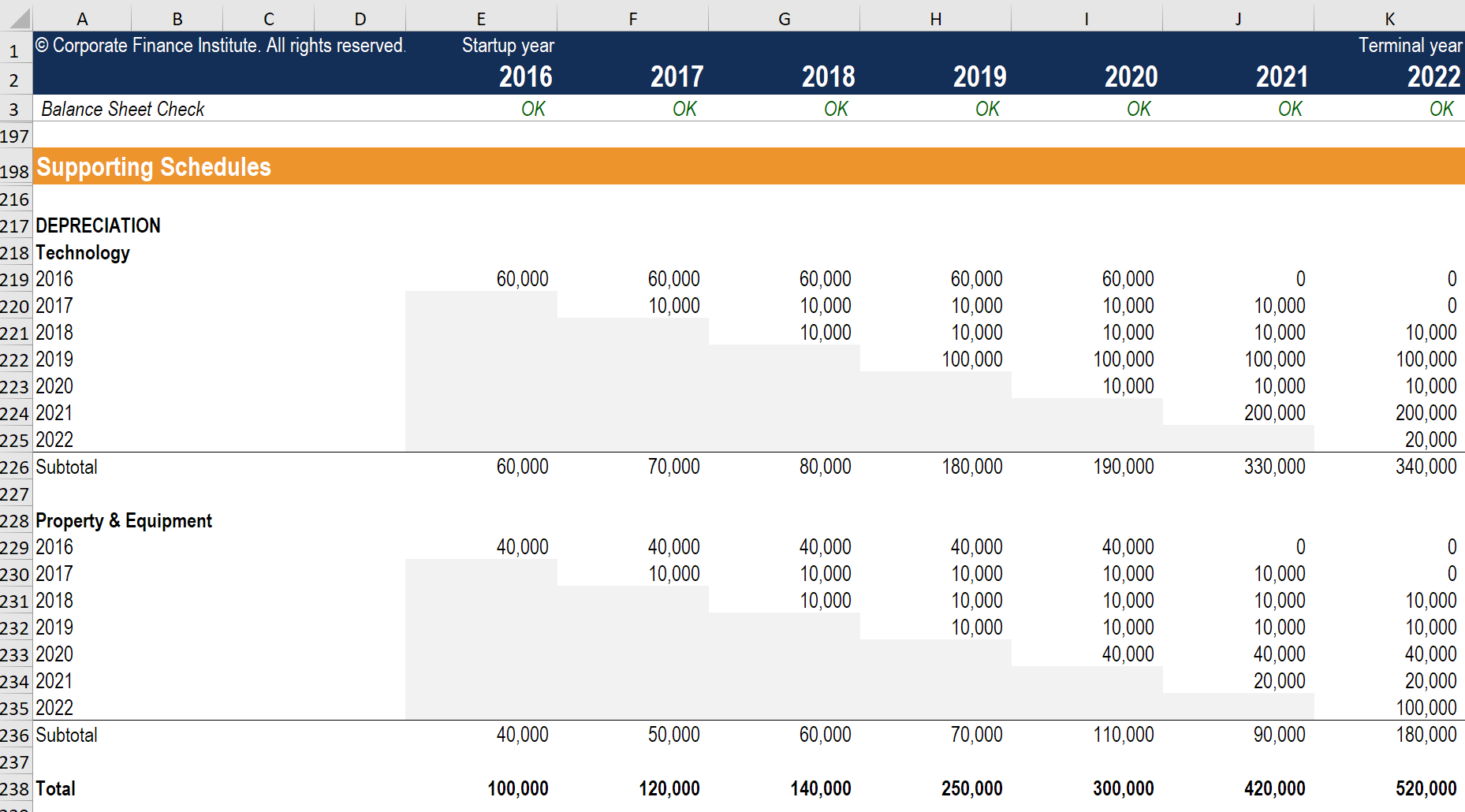

Depreciation Schedule Guide Example Of How To Create A Schedule

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Formula Examples With Excel Template

Depreciation Of Building Definition Examples How To Calculate

Free Macrs Depreciation Calculator For Excel

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation What Is The Depreciation Expense

An Excel Approach To Calculate Depreciation Fm

Depreciation And Book Value Calculations Youtube

Depreciation What Is The Depreciation Expense

Depreciation Formula Examples With Excel Template